taxes on fanduel sportsbook|How Taxes Work for Sports Bets From Sites Like FanDuel and : Manila The Player Activity Statement is a summary of your FanDuel wallet and gameplay activity. It summarizes transactional movement such as deposits, withdrawals, winnings, bets, and more. Learn more about the Player Activity Statement. Tingnan ang higit pa Random Pinay Scandal. @pinayscandalchannel 14.5K members. Random Pinay Scandal. Open a Channel via Telegram app

PH0 · Understanding Fanduel Earnings Taxes: Common

PH1 · Taxes with FanDuel Sportsbook

PH2 · Taxes on Sports Betting: How They Work, What’s

PH3 · Taxes

PH4 · TVG

PH5 · Sports Betting Taxes: How to Handle DraftKings,

PH6 · How to Pay Taxes on Sports Betting Winnings

PH7 · How Taxes Work for Sports Bets From Sites Like FanDuel and

PH8 · How Much Taxes Do You Pay On Sports Betting?

PH9 · FanDuel Taxes 2023: How to Pay Taxes on Betting Winnings & Losses

PH10 · FanDuel Taxes 2023: How to Pay Taxes on Betting

Watch Yung masikip pa pala ang nakadate sex on Kantotin. You can also watch hundreds of pinay sex scandals, premium porn and amateur sex videos in this site.

taxes on fanduel sportsbook*******FanDuel is legally prohibited from providing tax advice and unfortunately cannot answer this question. Instead, we highly suggest you reach out to a professional tax advisor with any personal income tax questions. You are solely responsible for recording, reporting, paying, and accounting for any . Tingnan ang higit pa

The Player Activity Statement is a summary of your FanDuel wallet and gameplay activity. It summarizes transactional movement such as deposits, withdrawals, winnings, bets, and more. Learn more about the Player Activity Statement. Tingnan ang higit pa

Tax Forms for a particular Tax year will be available for download on or after January 31st of the year after the calendar year in question. For example, 2023 Tax Forms will be . Tingnan ang higit paSome Tax Forms from previous calendar years are available following this link.All you need to do is click the applicable FanDuel products that you play on, select the . Tingnan ang higit paWe do not report annual profit or loss to the IRS for FanDuel Sportsbook, Casino, or Racing. FanDuel must report certain wagering transactions to the IRS on Form W-2G(s), but only .

Ago 2, 2024 — If you use online sportsbooks like DraftKings, PointsBet, and FanDuel, you might need to pay taxes. Learn the taxes you’ll pay, how to file .

How Taxes Work for Sports Bets From Sites Like FanDuel andAgo 2, 2024 — If you use online sportsbooks like DraftKings, PointsBet, and FanDuel, you might need to pay taxes. Learn the taxes you’ll pay, how to file .taxes on fanduel sportsbook How Taxes Work for Sports Bets From Sites Like FanDuel andAgo 2, 2024 — If you use online sportsbooks like DraftKings, PointsBet, and FanDuel, you might need to pay taxes. Learn the taxes you’ll pay, how to file .Mar 21, 2024 — For 2023 tax returns (taxes filed in 2024), the standard deduction is $13,850 for single filers and those married filing separately, $27,700 for those married filing jointly, and $20,800 for.TVG - Taxes, W2-Gs & Year End Reports. Due to updated regulations from the IRS regarding the reporting of wager winnings, there are only two specific circumstances in which winnings resulting from a wager are required to be .Mar 21, 2022 — Yes, FanDuel may periodically deduct taxes from your betting account. For instance, if you win $5,000 or more and the winnings are at least 300 times the wager, a portion of the earnings is kept. This varies by state. .Peb 24, 2024 — Explore the complexities of tax regulation compliance for Fanduel players in this comprehensive guide. Discover the significance of documenting both cash and non-cash prizes and learn about crucial IRS forms like 1099 .Abr 5, 2022 — Most sportsbooks and casinos will begin withholding federal taxes from your winnings on payouts of $5,000 or more. Think of it like your weekly paycheck. If any taxes on your winnings have already been withheld, make .

Hul 1, 2024 — Table of Contents. Are There Taxes or Fees on Sports Betting? DraftKings Sports Betting Taxes. FanDuel Sports Betting Taxes. How States Tax Legal Sports Betting. .

Hun 13, 2023 — Subscribed. 372. 21K views 9 months ago Your Money Briefing Podcast | WSJ. In 2022, legal sports wagers on sites like FanDuel and DraftKings totaled $93.2 billion. Wall .taxes on fanduel sportsbookAgo 23, 2024 — FanDuel Taxes; Our Verdict; FanDuel Sportsbook FAQ; Bet online with FanDuel in multiple states. Get access to live, real-money sports betting right now! Whether you’re at home or on the go, FanDuel sportsbook .

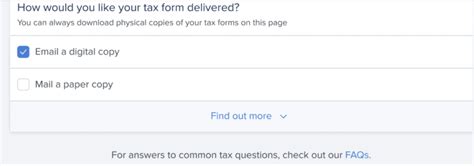

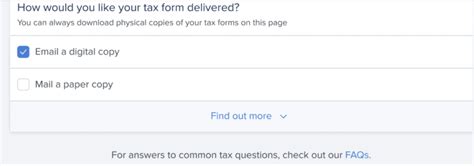

Welcome to the FanDuel Racing Tax Hub. This FAQ is intended to provide general answers to frequently asked questions related to these Tax Forms for Racing. . We do not report annual profit or loss to the IRS for FanDuel Sportsbook, Casino, or Racing. FanDuel is required to report certain wagering transactions to the IRS on Form W-2G(s), but .May 1, 2024 — FanDuel does not provide tax advice, nor should any statements in this agreement or on the Service be construed as tax advice. By agreeing to these Terms, you are consenting to electronic delivery of all informational tax forms such as Form 1099 and Form W-2G. . Sportsbook (Android) FOLLOW FANDUEL; Facebook; Twitter; Instagram; YouTube .Peb 24, 2024 — Explore the complexities of tax regulation compliance for Fanduel players in this comprehensive guide. Discover the significance of documenting both cash and non-cash prizes and learn about crucial IRS forms like 1099-MISC and W-2G. Delve into professional insights on the importance of meticulous financial record-keeping and seeking expert tax advice.DraftKings, FanDuel and other betting apps are facing a bigger tax hit in Illinois following changes to tax policy this year. New Jersey, Massachusetts and other states have also tried to raise taxes on the industry or plan to. DraftKings and FanDuel count Major League Baseball and the National Football League among their biggest partnerships.Hun 13, 2023 — In 2022, legal sports wagers on sites like FanDuel and DraftKings totaled $93.2 billion. Wall Street Journal tax reporter Laura Saunders joins host J.R. Whal.

FanDuel may be required to report your activity on our Daily Fantasy Sports/Faceoff products to the IRS and applicable state taxing authorities based on the IRS Form 1099 information reporting rules.Taxes with FanDuel Sportsbook; Taxes with FanDuel Casino; Taxes with FanDuel Daily Fantasy; Taxes with FanDuel Racing; Taxes with FanDuel Faceoff; Tax Center video overview. While logged in, you can also find this information for on your Account overview page or by navigating here.

Get answers for your Sportsbook, Casino, Daily Fantasy, TVG, Racing, or Faceoff questions . DISCLAIMER - We strongly recommend that you consult with a professional tax consultant when preparing your taxes as you may need to report your winnings even if you do not receive a W-2G and no winnings were withheld. Please note, TVG does not provide .Ago 2, 2024 — The DraftKings moneyline on the Colts also pays better than FanDuel’s, returning $155 on a $100 bet at DraftKings versus $144 from FanDuel. Bottom line: No single sportsbook can always offer the .

Mar 21, 2022 — Is your Form W2-G incomplete? This means that you have not satisfied the requirements for FanDuel to send you one of these forms. In summary, none of your wagers were eligible. This does not, however, imply .Download The FanDuel Sportsbook App How To Use App Ticket Redemption 1. Visit one of our Sportsbook locations and place any bet . Bets with winnings that trigger the collection of tax information (bets with 300-1 odds or greater .Hey everyone, So I won a $7.5k pool in FanDuel, and I was wondering if I pay taxes on that amount if I don't pull the money out of FanDuel. I think I don't because I can only send the money on more gambling on the FanDuel site unless I transfer it to my bank account.Ene 15, 2022 — That’s exactly what FanDuel Sportsbook is doing – the sportsbook is rewarding its new NY customers with a $1,000 risk-free bet. How this deal works is that you’re meant to make a qualifying bet first. . What is the tax rate on FanDuel? Same as all the other New York online sportsbooks, FanDuel also has to pay a 51% tax to the state .

1 day ago — FanDuel Sportsbook Virginia is noted for offering same-game parlays far more prominently than most big sportsbooks and being one of the easiest apps to use. A 2021 independent study by Eilers & Krejcik Gaming noted that FanDuel consistently earns high marks for user experience and betting interface. . Sportsbooks are subject to a 15% tax on .If you win money betting on sports from sites like DraftKings, FanDuel, or Bovada, it is also taxable income. Those sites should also send both you and the IRS a tax form if your winnings exceed $600.2 days ago — FanDuel Sportsbook is one of the top online sportsbooks in Illinois.Sign up with FanDuel Illinois today and receive a welcome bonus worth up to $200 in bonus bets.No FanDuel promo code is needed. FanDuel provides users with a plethora of betting options, from the most popular sports leagues like the NFL, NBA, NHL, MLB, college football, and college basketball .

Spread. Betting on NFL spreads is the cornerstone of pro football wagering and a favorite among pro bettors and beginners alike.. Unlike moneylines, books set a point value teams need to cover to win in spreads. For example, a negative value (-11.5) next to a football team means that they are favored by that many points.

taxes on fanduel sportsbook|How Taxes Work for Sports Bets From Sites Like FanDuel and